What is Equity Multiple in CRE?

Equity Multiple is a ratio used to evaluate the profitability of a CRE investment. It is calculated by dividing the total cash received from an investment (including both cash flow and sale proceeds) by the total equity invested. In simpler terms, it represents the multiple of the initial equity investment an investor can expect to receive back over the life of the investment.

For example, if you invest $1,000,000 and receive $2,000,000 in total cash over the investment period, your Equity Multiple is 2.0, meaning you have doubled your initial investment.

|

| sample Equity Multiple report that can be generated with TheAnalyst PRO |

An Equity Multiple of 1.0 represents that you received your initial investment back but didn’t make a profit.

Benefits of Understanding Equity Multiple:

- Performance measurement: Equity Multiple helps investors understand the overall performance of an investment, providing insights into potential returns.

- Comparing investment opportunities: Equity Multiple allows investors to compare different investment opportunities on a relative basis, making it easier to choose the best option.

- Risk assessment: A higher Equity Multiple may indicate higher potential returns but could also signal a riskier investment.

Calculating Equity Multiple using TheAnalyst PRO:

TheAnalyst PRO is a powerful investment analysis tool designed for commercial real estate professionals. With its easy-to-use interface and robust functionality, it simplifies the process of calculating the Equity Multiple for a CRE investment.

Here's how you can use TheAnalyst PRO to calculate Equity Multiple:

- Input property information: Begin by entering basic property information, including purchase price, income, expenses, and holding period.

- Input financial assumptions: Provide assumptions for loan terms, interest rates, and other financial variables.

- Analyze cash flow: TheAnalyst PRO will generate a cash flow analysis, showing annual cash flow, cumulative cash flow, and eventual sale proceeds.

- Calculate Equity Multiple: The tool will automatically calculate the Equity Multiple by dividing the total cash received by the initial equity investment.

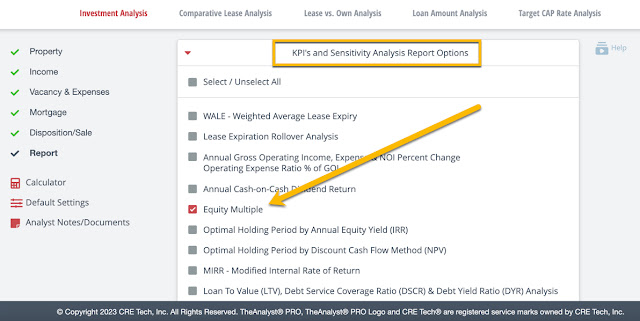

To include the Equity Multiple Graph section in your Investment Analysis report, simply check box the Equity Multiple option in the KPI (Key Performance Indicator) and Sensitivity Analysis Report Option section.

|

| where to find the Equity Multiple report option in TheAnalyst PRO |

Understanding Equity Multiple is crucial for CRE investors to make informed decisions. TheAnalyst PRO makes it easy to calculate this important financial metric, helping you compare investment opportunities and assess their potential returns. With this knowledge, you can confidently choose the best investment option for your financial goals.