Understanding Commercial Real Estate Metrics

by: Todd A. Kuhlmann, CCIM

Commercial real estate investment can be confusing, especially when it comes to evaluating the performance of a property. Two common metrics used to assess the financial health of a commercial property are CAP Rate and Cash-on-Cash. However, many real estate investors are often confused about the differences between these two metrics and their significance in evaluating the performance of a commercial property.

CAP Rate (Capitalization Rate)

CAP rate is one of the most commonly used metrics in commercial real estate worldwide but is also one of the most abused and misused metrics. We at TheAnalyst PRO define CAP rate as: The investment measure used to determine the VALUE of an income producing property. CAP is calculated by using a property's 1-year Net Operating Income (NOI) and dividing it by the value or price of the property. CAP Rate is often misused to calculate a return on the investment, but it does not calculate a return on the investor's equity investment. It is used by appraisers to determine value based on comparable property sales using the CAP Rates from comparable properties that have sold recently. The appraiser will then apply the market CAP Rate to the subject property in order to determine the value of that property for a given point in time. Brokers and property owners also use CAP Rate to determine the value of their property at a specific point in time as it relates to the current Net Operating Income of the property.

CAP rate and value have an inverse relationship, meaning when CAP rates increase, the price or value of the property decreases. CAP rate is typically used when purchasing the property and a second time when valuing the property at time of sale. You can use the simple CAP Rate calculator in TheAnalyst PRO to create a good visual of the formula. In this example, the 1-year NOI on the property is $100,000 and the CAP Rate is 10%. When tapping on Value the result is $1,000,000.

Cash-on-Cash

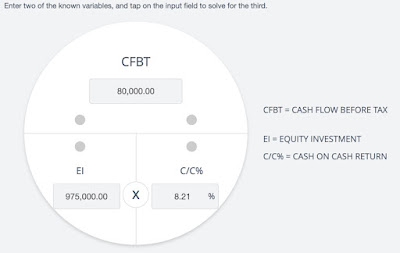

Cash-on-Cash is another popular metric used to evaluate the performance of commercial real estate investments. In TheAnalyst PRO’s glossary, we define Cash-on-Cash as an annual return during property ownership and operation. This investment measure is calculated using the annual before-tax cash flow for a given year divided by the initial investment. We compare the Cash-on-Cash return to a "Dividend" return as it does not consider property appreciation or sales proceeds upon sale. It is the percent return on the cash flow from operations of the property in relationship to the original initial investment at the time of purchase. It represents the amount of cash an investor receives from their investment as a percentage of the cash they have invested. Cash-on-Cash is calculated by dividing the Cash Flow Before Tax by the investor’s initial equity investment.

You can use the Cash-on-Cash calculator in TheAnalyst PRO to create a good visual of the formula. In this example, the 1-year Cash Flow Before Tax (CFBT) on the property is $80,000 and the initial Equity Investment (EI) is $975,000. When tapping on C/C% the result is 8.21%.

Why it is important

Both CAP rate and Cash-on-Cash are important metrics in evaluating commercial real estate investments. However, they should not be considered in isolation, as they both have their pros and cons.

CAP rate provides a quick and simple way to assess the value of an investment, making it useful for comparing different properties. However, it does not consider the actual equity investment and financing structure of a property.

Cash-on-Cash, on the other hand, takes into account the financing structure of a property and provides a clearer picture of the return an investor can expect to receive on their investment. It is useful for investors who want to know the annual dividend return they will receive after factoring in mortgage payments and other expenses. However, it does not provide a complete picture of a property’s financial health, as it does not consider the growth in future cash flows or property appreciation.

Some commercial real estate professionals argue that the CAP rate is the same as Cash-on-Cash return when paying cash and not financing the property. This would only be the case if there were no cost incurred to acquire the property, such as legal, recording and title fees, and there were no expense incurred that is not included in the NOI, such as capital expenditures, funded reserves, and leasing commissions. Acquisition costs increase the required Equity Investment. When teaching CAP Rate, we like to simply say that CAP rate does not care about the investors’ money, whereas Cash-on-Cash considers the investors’ equity and 1-year cash flow distributed.

In conclusion, since CAP rate and Cash-on-Cash are important metrics in evaluating the performance, investors should consider both metrics when evaluating a property and make sure they are comfortable with the financing structure before investing. It is important to understand that no single metric provides a complete picture of a property’s financial health, and investors should always perform a thorough analysis before investing in commercial real estate.

TheAnalyst PRO makes the complex financial analyzation of commercial real estate easy. Gain access to our extensive CRE glossary as well as 20 other calculator, analysis, demographic, and marketing tools.

For more details on comparing CAP rates to Cash-on-Cash and other investment measures, we have created a full video on demand training center in TheAnalyst PRO.

Sign up for a Demo today to learn more about how TheAnalyst PRO can take your Commercial Real Estate business to the next level!

Todd Kuhlmann, CCIM is the Founder & CEO of TheAnalyst PRO by CRE Tech, Inc. He is an international speaker and trainer for commercial real estate investment analysis and CRE technology.